A checkbook balance is the in-house general ledger record of your bank account, whereas the bank statement is the balance reported by the bank at the end of the mind. Changes in one account automatically show up in the other.Įach account has its own currency and every document has a base currency so your reports and totals just make sense. Checkbook Balance vs Bank Statement Balance.

#Checkbook pro support pdf#

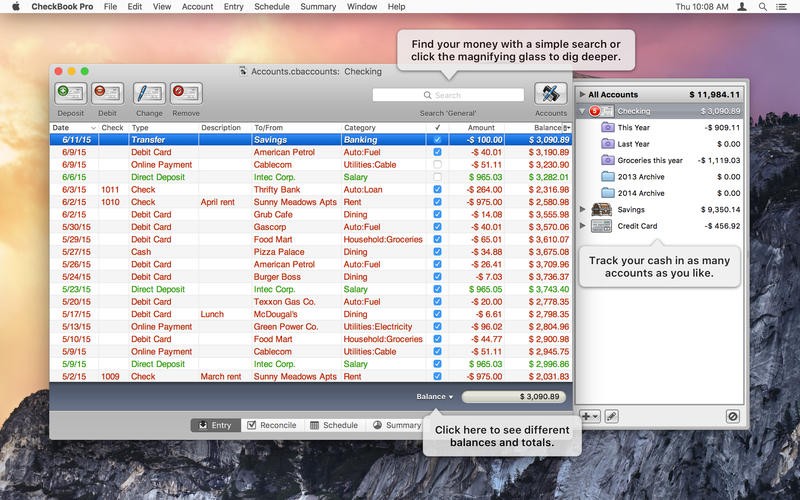

View your reports onscreen, print to paper, or create a PDF to archive or share.ĭebit from one account and deposit into another without creating two separate transactions. Track cash flow over time with customizable reports so you can see where your money came from and where it's going. Third Sunday of every other month? Why not? If you can imagine it, you can schedule it. Second and fourth Wednesday of every month? Not a problem. Enter your statement ending balance, mark transactions as cleared, whittle your unreconciled total down to zero, and you're done. Made in the shade: Get a good deal and good advice on window treatments. Getting help from a pro for planning where to go. It's a breeze to show transactions with a specific category or amount, to see everything for last month or a custom date range, or to hide all but your unreconciled transactions.īalance your Accounts at will with a streamlined reconciliation workflow. Dealers promise rigorously inspected rides and peace-of-mind warranties, but we found some consumers get rebuilt wrecks and even a former crash-test vehicle. Search options help you find whatever you're looking for and customize your workflow. You will be asked to enter authorization data you use in the Bank’s Dashboard. More than you'd expect from your average personal finance manager. Before you buy Money Pro Gold subscription please tap/click Check if your bank is supported in the subscription window.

0 kommentar(er)

0 kommentar(er)